-

Q3 revenue of $2.4 million, a 43% increase from the prior year third quarter. Income from grants was $0.3 million, and the total of revenue and income from grants was $2.7 million.

-

Net loss in Q3 of $11.5 million or $0.22 per share.

-

Company holds cash reserves of $42.4 million as of September 30, 2022.

Summary of Operational Highlights

-

Official ratification received from the European Commission of the European Union for funding of €782.1 million under the Important Projects of Common European Interest (“IPCEI”) Hydrogen – Technology for Advent’s Green HiPo project.

-

Three-year agreement with the German State of Brandenburg for the supply of methanol-powered fuel cell systems, which will be installed in select critical communication sites in the region.

-

The successful delivery of Advent’s portable fuel cell products to the Hellenic Army’s Special Operations Units.

-

Launch of Honey Badger 50™, a compact portable fuel cell system and quiet power supply for use in off-grid field applications.

-

Memorandum of Understanding with DEPA Commercial S.A., the leading importer of pipeline gas and liquefied natural gas in Greece, for the strategic collaboration on hydrogen projects of common interest.

-

Memorandum of Understanding with the New York State Energy Research and Development Authority and more than 60 clean hydrogen ecosystem partners, to develop a proposal that will enable the Northeastern United States to become one of at least four regional clean hydrogen hubs designated through the federal Regional Clean Hydrogen Hubs program, included in the bipartisan Infrastructure Investment and Jobs Act.

-

Memorandum of Understanding with Hydrogen Systems, Inc., a hydrogen energy solutions company based in Riyadh, Saudi Arabia, to provide integrated hydrogen solutions and value-added support to industrial and renewable energy markets in the Middle East.

BOSTON--(BUSINESS WIRE)--Advent Technologies Holdings, Inc. (NASDAQ: ADN) (“Advent” or the “Company”), an innovation-driven leader in the fuel cell and hydrogen technology space, today announced its consolidated financial results for the three months ended September 30, 2022. All amounts are in U.S. dollars unless otherwise noted and have been prepared in accordance with U.S. generally accepted accounting principles (“GAAP”).

Q3 2022 Financial Highlights

(All comparisons are to Q3 2021, unless otherwise stated)

-

Revenue of $2.4 million, a 43% year-over-year increase.

-

Operating expenses of $10.8 million, a year-over-year decrease of $3.2 million, primarily due to $2.4 million of executive severance recognized in the prior year third quarter, as well as a year-over-year reduction in stock-based compensation expenses of $0.6 million.

-

Net loss was $11.5 million, and adjusted net loss was $10.6 million. Adjusted net loss excludes a $0.9 million loss from the change in the fair value of outstanding warrants.

-

Net loss per share was $0.22.

-

Cash reserves were $42.4 million as of September 30, 2022, a decrease of $4.1 million from June 30, 2022. In the third quarter of 2022, the Company received $3.8 million in tenant improvement allowances for the Hood Park R&D and manufacturing facility in Charlestown, MA, which is net of additional spending for the build-out of the facility.

“Advent continued to make significant progress in the last quarter. Our Green HiPo project was ratified by the EU in July, which now clears the way for the Greek State to provide the appropriate funding,” said Dr. Vasilis Gregoriou, Chairman and CEO of Advent Technologies. “Advent has also made significant progress entering into several MoUs for new business globally. We have continued to streamline our operations which has resulted in a clear focus on core technical excellence in our key market sectors, and this has enabled us to gain commercial traction from global OEMs. Advent will actively pursue this commercial strategy, which will augment our pipeline with quality opportunities and partnerships. Along with Green HiPo, we remain confident that we are on a firm path for growth, and we look forward to keeping you appraised of future developments.”

Q3 2022 Business Updates

Inaugural Investor Day: On July 7, 2022, Advent hosted its 2022 Investor Day, where Advent’s executives and senior leadership discussed the Company’s most recent advancements with its fuel cell products and systems, hydrogen development projects, and business activities in markets across the U.S., Europe and Asia. The key areas that were addressed were:

-

The Company’s Green HiPo Project, with planned funding of €782.1 million over six years from the Greek State, aimed at producing HT-PEM fuel cells and electrolysers to decarbonize global power production via hydrogen.

-

R&D partnerships and collaborations with OEMs, the U.S. Department of Energy and the U.S. Department of Defense.

-

Innovations in HT-PEM MEAs and water electrolysis.

-

Advent’s commercial activities in global markets aimed at replacing existing power systems with hydrogen alternatives.

Green HiPo Receives Ratification from the EU: On July 18, 2022, Advent announced that its Green HiPo project under the framework of the Important Projects of Common European Interest (“IPCEI”) Hydrogen – Technology, received official ratification from the European Commission (“EC”) of the European Union. The ratification of Green HiPo was among 41 projects under the umbrella “IPCEI Hy2Tech” jointly prepared and notified by fifteen Member States: Austria, Belgium, Czechia, Denmark, Estonia, Finland, France, Germany, Greece, Italy, Netherlands, Poland, Portugal, Slovakia, and Spain. The Member States will provide up to €5.4 billion in public funding, which is expected to unlock an additional €8.8 billion in private investments. As part of this IPCEI, 35 companies with activities in one or more Member States, including small and medium-sized enterprises (“SMEs”) and start-ups, will participate in these 41 projects. Advent is one of only eight SMEs to have received ratification. The direct participants will closely cooperate with each other through numerous planned collaborations and also with more than 300 external partners, such as universities, research organizations, and SMEs across Europe. The IPCEI will cover a wide part of the hydrogen technology value chain, including: (i) the generation of hydrogen, (ii) fuel cells, (iii) storage, transportation, and distribution of hydrogen, and (iv) end-users’ applications, in particular the mobility sector. Advent participates in both the generation of hydrogen and fuel cells.

According to a press release issued by the Hellenic Ministry of Development and Investments, the EC approved State Aid for Greece up to the amount of €800 million public expenditure, including €782.1 million for Green HiPo. In making its assessment, the EC determined that the Green HiPo project satisfied its requirements, which include that:

-

The project contributes to a common objective by supporting a key strategic value chain for the future of Europe, as well as the objectives of key EU policy initiatives such as the Green Deal, the EU Hydrogen Strategy, and REPowerEU;

-

The IPCEI is highly ambitious, as it is aimed at developing technologies and processes that go beyond what the market currently offers and will allow major improvements in performance, safety, environmental impact as well as cost efficiencies;

-

The IPCEI also involves significant technological and financial risks, and public support is, therefore, necessary to provide incentives to companies to carry out the investment; and

-

The results of the project will be widely shared by participating companies benefitting from the public support with the European scientific community and industry beyond the companies and countries that are part of the ICPEI. As a result, positive spill-over effects will be generated throughout Europe.

Over the initial funding period and in accordance with Green HiPo’s parameters, Advent will innovatively develop, design, and manufacture fuel cell systems and electrolyser systems in Greece’s Western Macedonia region.

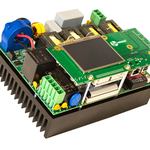

Launch of the Honey Badger 50™ Fuel Cell System: On August 4, 2022, Advent announced the launch of its Honey Badger 50™ (“HB50”), a compact portable fuel cell system and quiet power supply for use in off-grid field applications such as military and rescue operations. The launch of Advent’s portable power system coincided with the Company’s fulfilment of its first shipment order from the U.S. Department of Defense. The HB50 power system can be fuelled by biodegradable methanol, allowing near silent generation of up to 50W of continuous power with clean emissions. Designed for covert operations, HB50 can easily power radio and satellite communications gear, remote fixed and mobile surveillance systems, and laptop computers along with more general battery charging needs. HB50 is a unique technology that can provide 65% of weight savings versus batteries over a typical 72-hour mission. The weight savings benefit increases further for longer missions.

HB50’s unique design allows it to be used in soldier-worn configurations or operated inside a portable backpack or vehicle while charging batteries and powering soldier systems, while its thermal features allow it to operate within an ambient temperature range of -20°C to +55°C. Aside from its optimized compatibility with Integrated Visual Augmentation System (“IVAS”), HB50 can also power devices such as high frequency radios like the model 117G, as well as B-GAN and StarLink terminals. HB50’s durability allows it to be easily deployed in challenging conditions and climates while supporting mission mobility for three to seven days without the need to re-supply.

Since Honey Badger’s fuel cell technology can run on hydrogen or liquid fuels, the system can operate at a fraction of the weight of traditional military-grade batteries to meet the U.S. Department of Defense’s continuously evolving needs for ‘on-the-go’ electronics. As military adoption and use of IVAS equipment continues to evolve, the highly portable lightweight power solutions like Honey Badger will become a mission critical necessity.

Memorandum of Understanding (“MoU”) with DEPA Commercial S.A.: On August 8, 2022, Advent announced the signing of a MoU with DEPA Commercial S.A., the leading importer of pipeline gas and liquefied natural gas (“LNG”) in Greece, to enter into a strategic collaboration on hydrogen projects of common interest. The MoU sets out the framework for a forthcoming mutually binding agreement. The parties have preliminarily agreed to the following actions:

-

Collaborate on the production of environmentally friendly hydrogen as a fuel with the participation of other major industrial partners.

-

Co-develop a proprietary and highly differentiated CHP system ready for mass production with efficiency approaching 90% and with multi-fuel operating capabilities (such as hydrogen, natural gas, efuels) that can address the key current, future, and on-grid, off-grid operation modes and business cases.

-

Create an innovation hub for the Greek hydrogen and fuel cell industry and develop synergies for promoting hydrogen and related technologies.

Delivery of Advent’s Portable Fuel Cell Products to the Hellenic Army’s Special Operations Units: On August 17, 2022, Advent announced the successful delivery of Advent’s portable fuel cell products to the Hellenic Army’s Special Operations Units. Advent’s fuel cell technology powers a highly sophisticated, incredibly portable battery charger designed to meet the rugged off-grid power needs in performance-demanding settings, such as those regularly faced by the Hellenic Army’s Special Operations Units and other military divisions. The portable fuel cell can be quickly and efficiently utilized by remote military units to power off-grid radio, surveillance gear, and other mobile electronic military equipment by operating under even the most challenging combat conditions. Advent’s portable fuel cell uses the Company’s proprietary methanol reformation technology to deliver premium performance alongside a significant reduction in size and weight.

Being lightweight and compact, the portable fuel cell fits in soldier plate carrier systems and rucksacks, maximizing efficiency and portability across a full range of military operations. The portable fuel cell delivers up to 50W of continuous power and up to 85W of peak power, ensuring a reliable charging experience to a wide variety of the high-power electronic devices regularly used by the Hellenic Army’s Special Operations Units in deployment. Advent’s portable fuel cell operates silently and can run uninterrupted off-grid for up to two weeks with a single hot-swappable fuel tank. The portable fuel cells have been deployed successfully within the framework of PARMENION National large-scale Joint Exercise.

Memorandum of Understanding with the New York State Energy Research and Development Authority (“NYSERDA”): On August 31, 2022, Advent announced that it co-signed a MoU with the NYSERDA and more than 60 clean hydrogen ecosystem partners. Under the MoU, the parties will collaborate to develop a proposal that will enable the Northeastern United States to become one of at least four regional clean hydrogen hubs designated through the federal Regional Clean Hydrogen Hubs program, included in the bipartisan Infrastructure Investment and Jobs Act.

The coalition of six states (Connecticut, Massachusetts, Maine, New Jersey, New York, and Rhode Island), along with more than 60 clean hydrogen ecosystem partners, are laying the groundwork for a proposal for the U.S. Department of Energy funding opportunity, with up to $8 billion in total funding available. After the initial announcement in March 2022, New York has continued to add strategic partners that now include 14 private sector industry leaders, 12 utilities, 20 hydrogen technology original equipment manufacturers, 10 universities, seven non-profit organizations, five other states, two transportation companies, and three state agencies.

Consortium partners have committed to collaborate with the NYSERDA, New York Power Authority, and Empire State Development for the development of the proposal to advance clean hydrogen projects. At the same time, partnering states will also coordinate with their respective state entities to help align the consortium’s efforts with each state’s climate and clean energy goals, such as Massachusetts goal of reaching net-zero carbon emissions by 2050. With the execution of these agreements, the partners will work together to:

-

Define the shared vision and plans for the regional clean hydrogen hub that can advance safe, clean hydrogen energy innovation and investment and address climate change while improving the health, resiliency, and economic development of the region’s residents.

-

Advance a hydrogen hub proposal that makes climate and environmental concerns central to its strategy, which will deliver opportunities and improve the quality of life for under-resourced areas in the region.

-

Perform research and analysis necessary to support the hydrogen hub proposal and to quantify the reduction of greenhouse gas emissions resulting from this project.

-

Develop a framework to ensure the ecosystem for innovation, production, infrastructure, and related workforce development is shared across all partner states.

-

Support environmentally responsible opportunities to develop clean hydrogen in accordance with the participating states’ policies.

The coalition will continue to focus on the integration of renewables – such as onshore and offshore wind, hydropower, and solar PV – and nuclear power into clean hydrogen production and the evaluation of clean hydrogen for use in transportation, including for medium and heavy-duty vehicles, heavy industry, power generation applications, and other appropriate uses consistent with decarbonization efforts.

Memorandum of Understanding with Hydrogen Systems, Inc. (“Hydrogen Systems”): On September 15, 2022, Advent announced the signing of an MoU with Hydrogen Systems, a hydrogen energy solutions company based in Riyadh, Saudi Arabia, to provide integrated hydrogen solutions and value-added support to industrial and renewable energy markets in the Middle East. Under the MoU, Hydrogen Systems aims to utilize a vast number of its existing relationships in the telecom and hydrogen energy marketplace in the Kingdom of Saudi Arabia, and elsewhere throughout the Middle East to market, sell, distribute, install, and service Advent’s full line of high-temperature proton exchange membrane (“HT-PEM”) fuel cells and hydrogen production products. Simultaneously, Advent and Hydrogen Systems intend to collaborate and explore potential large-scale development opportunities for hydrogen fuel cell power applications across the region.

Advent’s family of products, including the Serene and M-ZERO® fuel cell systems, realize a significant carbon advantage over conventional diesel remote power generation technology. HT-PEM fuel cells can operate with a range of low or zero-carbon hydrogen fuels and enable more efficient heat management. Such fuel cells can produce power in extreme ambient temperatures (from -40°C to up to +55°C) and conditions such as high air pollution and low humidity, resulting in a longer lifetime and lower total cost of ownership.

Agreement with the German State of Brandenburg: On September 19, 2022, Advent announced the signing of a three-year agreement with the German State of Brandenburg for the supply of methanol-powered fuel cell systems, which will be installed in select critical communication sites in the region. Advent’s methanol-powered fuel cell systems will be used as a back-up power source for Brandenburg’s BOS digital radio network, replacing the diesel-driven emergency power systems at several sites over the next three years. Germany’s old public safety and security infrastructure relied on an outdated analogue radio system for communication. BOS is a digital, encrypted, and secure means of communication. The new BOS network allows first responders and other public safety officials to communicate easily and securely. The BOS network now covers 99.2% of German territory.

Advent’s solution was selected as part of a tender launched by the German State of Brandenburg, which requested that fuel cell and hydrogen technology companies submit proposals for sustainable and reliable emergency power supply solutions. Prior to Advent’s selection, the performance of the Company’s methanol-powered fuel cells was tested at a site of the BOS digital radio network in Brandenburg, providing further proof of concept for the use of HT-PEM fuel cells as an efficient back-up power source for critical infrastructure applications. Advent’s methanol-powered fuel cells deliver reliable power in an environmentally friendly way – reducing CO2 emissions and operating near silently – while having a low impact on the surroundings. Methanol, as a carrier of hydrogen, allows simpler storage than pure hydrogen and enhances the safety of operations.

Conference Call

The Company will host a conference call on Monday, November 14, 2022, at 9:00 AM ET to discuss its results.

To access the call please dial (888) 660-6182 from the United States, or (929) 203-0891 from outside the U.S. The conference call I.D. number is 3273042. Participants should dial in 5 to 10 minutes before the scheduled time.

A replay of the call can also be accessed via phone through November 28, 2022, by dialing (800) 770-2030 from the U.S., or (647) 362-9199 from outside the U.S. The conference I.D. number is 3273042.

About Advent Technologies Holdings, Inc.

Advent Technologies Holdings, Inc. is a U.S. corporation that develops, manufactures, and assembles complete fuel cell systems, and the critical components for fuel cells in the renewable energy sector. Advent is headquartered in Boston, Massachusetts, with offices in California, Greece, Denmark, Germany, and the Philippines. With more than 150 patents issued, pending, or licensed worldwide for fuel cell technology, Advent holds the IP for next-generation HT-PEM that enable various fuels to function at high temperatures and under extreme conditions – offering a flexible option for the automotive, aviation, defense, oil and gas, marine, and power generation sectors. For more information, please visit www.advent.energy.

Cautionary Note Regarding Forward-Looking Statements

This press release includes forward-looking statements. These forward-looking statements generally can be identified by the use of words such as “anticipate,” “expect,” “plan,” “could,” “may,” “will,” “believe,” “estimate,” “forecast,” “goal,” “project,” and other words of similar meaning. Each forward-looking statement contained in this press release is subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statement. Applicable risks and uncertainties include, among others, the Company’s ability to maintain the listing of the Company’s common stock on Nasdaq; future financial performance; public securities’ potential liquidity and trading; impact from the outcome of any known and unknown litigation; ability to forecast and maintain an adequate rate of revenue growth and appropriately plan its expenses; expectations regarding future expenditures; future mix of revenue and effect on gross margins; attraction and retention of qualified directors, officers, employees, and key personnel; ability to compete effectively in a competitive industry; ability to protect and enhance our corporate reputation and brand; expectations concerning our relationships and actions with our technology partners and other third parties; impact from future regulatory, judicial and legislative changes to the industry; ability to locate and acquire complementary technologies or services and integrate those into the Company’s business; future arrangements with, or investments in, other entities or associations; and intense competition and competitive pressure from other companies worldwide in the industries in which the Company will operate; and the risks identified under the heading “Risk Factors” in our Annual Report on Form 10-K filed with the Securities and Exchange Commission on March 31, 2022, as well as the other information we file with the SEC. We caution investors not to place considerable reliance on the forward-looking statements contained in this press release. You are encouraged to read our filings with the SEC, available at www.sec.gov, for a discussion of these and other risks and uncertainties. The forward-looking statements in this press release speak only as of the date of this document, and we undertake no obligation to update or revise any of these statements. Our business is subject to substantial risks and uncertainties, including those referenced above. Investors, potential investors, and others should give careful consideration to these risks and uncertainties.

Presentation of Non-GAAP Financial Measures

In addition to the results provided in accordance with U.S. GAAP throughout this press release, the Company has provided non-GAAP financial measures - Adjusted Net Income / (Loss) and Adjusted EBITDA - which present results on a basis adjusted for certain items. The Company uses these non-GAAP financial measures for business planning purposes and in measuring its performance relative to that of its competitors.

Contacts

Advent Technologies Holdings, Inc.

Naiem Hussain

This email address is being protected from spambots. You need JavaScript enabled to view it.

Chris Kaskavelis

This email address is being protected from spambots. You need JavaScript enabled to view it.

Read full story here