PORTLAND, Ore.--(BUSINESS WIRE)--Northwest Natural Holding Company, (NYSE: NWN) (NW Natural Holdings), reported financial results and highlights including:

-

Reported a net loss of $0.67 per share for the third quarter of 2021, compared to a net loss of $0.61 per share from continuing operations for the same period in 2020

-

Earned net income of $1.24 per share for the first nine months of 2021 for an increase of $13.7 million or 55%, compared to earnings from continuing operations of $0.80 per share for the same period in 2020

-

Added nearly 12,000 natural gas meters in the last 12 months for a growth rate of 1.5% at Sept. 30, 2021

-

Invested over $200 million in our utility systems in the first nine months of 2021 for greater reliability and resiliency

-

Received Washington rate case order approving a two-year adjustment that combined has an estimated pre-tax earnings benefit of up to $8 million

-

Received approval in Oregon and Washington for new rates related to the Purchased Gas Adjustment (PGA) mechanism, which includes estimated gas costs for the upcoming winter heating season

-

Launched a competitive renewable energy strategy

-

Increased our dividend for the 66th consecutive year to an annual indicated dividend rate of $1.93 per share

-

Reaffirmed 2021 earnings guidance in the range of $2.40 to $2.60 per share

"This quarter highlights our commitment to decarbonization, diversification, and growth," said David H. Anderson, president and CEO of NW Natural Holdings. "We've made significant progress toward procuring RNG for our gas utility customers, demonstrating the critical role our system is playing to help move to a low-carbon, renewable energy future. With our new competitive renewables strategy, we're able to assist a broader group of customers with the energy transition. Our initial partnership and investment represents an exciting first step. I'm proud of our achievements to date and our long-term growth prospects."

For the third quarter of 2021, the net loss increased $2.0 million to a $20.7 million net loss (or $0.67 per share), compared to a net loss from continuing operations of $18.7 million (or $0.61 per share) for the same period in 2020. The third quarter reflects the seasonal nature of the gas utility's earnings where the majority of revenues are generated during the winter heating season in the first and fourth quarters each year. Results reflected higher operations and maintenance expenses and higher depreciation and general tax expenses as we continued to invest in our gas utility system, partially offset by customer growth and new rates in Oregon for our natural gas utility.

Year-to-date net income increased $13.7 million to $38.1 million (or $1.24 per share), compared to $24.5 million (or $0.80 per share) for the same period in 2020. Results reflected customer growth and new rates in Oregon for our natural gas utility, partially offset by higher operations and maintenance expenses, depreciation and general tax expenses. In addition, net income from our other activities increased primarily due to higher asset management revenues.

KEY EVENTS AND INITIATIVES

The after-tax drivers below are based on a statutory tax rate of 26.5%.

Received Order in NW Natural's Washington General Rate Case

On Dec. 18, 2020, NW Natural filed a request for a general rate increase with the Washington Utilities and Transportation Commission (WUTC). Approximately 10% of NW Natural’s revenues are derived from its Washington customers. The original filing included a requested increase in annual revenue requirements over two years to recover operating costs and infrastructure and technology investments. This included a $6.3 million increase in the first year beginning November 1, 2021 (Year One) and a $3.2 million increase in the second year beginning November 1, 2022 (Year Two).

On Oct. 21, 2021, the WUTC issued an order approving the multi-party settlement in NW Natural's general rate case. The order increases the revenue requirement $5.0 million in Year One and up to an additional $3.0 million increase in Year Two. The order includes a cost of capital of 6.814% for both years and rate base of $247.3 million as of November 1, 2022 or an increase of $31.2 million for Year 1 and $21.4 million for Year 2. New rates in Washington were effective beginning Nov. 1, 2021.

Coronavirus (COVID-19)

We estimate the financial effects of COVID-19 in the income statement to be $1.7 million (after-tax) for the first nine months of 2021, compared to approximately $1.3 million (after-tax) for the same period in 2020. The 2021 financial effects include $0.7 million (after-tax) of revenue we expect to recognize in a future period related to forgone late fees. The remaining $1.0 million (after-tax) will not be recovered through rates as it primarily relates to lower natural gas distribution margin from customers that stopped natural gas service, partially offset by management cost savings initiatives.

Utility Renewable Natural Gas (RNG)

NW Natural continues to pursue RNG supply for our customers under the landmark Oregon Senate Bill 98, which supports renewable energy procurement and investment by natural gas utilities. NW Natural has options to invest up to a total estimated $38 million in four separate RNG development projects that will access biogas derived from water treatment at Tyson Foods’ processing plants. Construction on our first RNG facility with BioCarbN and Tyson Foods began this fall with completion and commissioning planned for early 2022. To date, NW Natural has signed agreements with options to purchase or develop RNG for utility customers totaling about 2% of NW Natural’s annual sales volume in Oregon.

NW Natural Renewables Launches Competitive RNG Strategy

NW Natural Renewables is a newly formed and non-regulated subsidiary of NW Natural Holdings committed to leading the energy transition and providing renewable fuels to the utility, commercial, industrial and transportation sectors. NW Natural Renewables is focused on providing cost-effective solutions to decarbonize a variety of sectors utilizing existing waste streams and renewable energy resources.

“The renewables business is a natural progression of the insights and capabilities we’ve gained as a leader addressing the energy transition,” said David H. Anderson, NW Natural Holdings president and CEO. “We have strong confidence in the long-term demand for renewable fuels across the country and across various customer classes. This business represents a significant opportunity for us to add earnings and cash flows in a fast-growing market segment.”

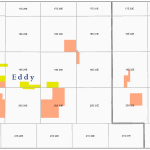

NW Natural Renewables' first project is with EDL, a leading global producer of sustainable distributed energy. We've executed agreements to commit $50 million toward the development of two production facilities that are designed to convert landfill waste gases to RNG and connect gas production to existing regional pipeline networks. We've also executed agreements with EDL designed to secure a 20-year supply of RNG that NW Natural Renewables intends to market primarily under long-term contracts.

Under the agreements, NW Natural Renewables is committed to investing in RNG infrastructure at two U.S. landfills, which are owned and operated by an industry leader in recycling and non-hazardous solid waste disposal. Construction for these projects is planned to begin in early 2022, with substantial completion and commissioning of the first facility anticipated in early 2023 and the second facility in spring 2023. We expect to fund our investment once commercial operations are achieved for each of the projects.

THIRD QUARTER RESULTS

The following financial comparisons are for the third quarter of 2021 and 2020 with individual year-over-year drivers below presented on an after-tax basis using a statutory tax rate of 26.5% unless otherwise noted.

NW Natural Holdings' third quarter results are summarized by business segment in the table below:

|

|

Three Months Ended September 30,

|

|

|

2021

|

|

2020

|

|

Change

|

In thousands, except per share data

|

|

Amount

|

|

Per Share

|

|

Amount

|

|

Per Share

|

|

Amount

|

|

Per Share

|

Net income (loss) from continuing operations:

|

|

|

|

|

|

|

|

|

|

|

|

|

Natural Gas Distribution segment

|

|

$

|

(23,297

|

)

|

|

$

|

(0.76

|

)

|

|

$

|

(22,120

|

)

|

|

$

|

(0.72

|

)

|

|

$

|

(1,177

|

)

|

|

$

|

(0.04

|

)

|

Other

|

|

2,642

|

|

|

0.09

|

|

|

3,443

|

|

|

0.11

|

|

|

(801

|

)

|

|

(0.02

|

)

|

Consolidated

|

|

$

|

(20,655

|

)

|

|

$

|

(0.67

|

)

|

|

$

|

(18,677

|

)

|

|

$

|

(0.61

|

)

|

|

$

|

(1,978

|

)

|

|

$

|

(0.06

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted Shares

|

|

|

|

30,696

|

|

|

|

|

30,555

|

|

|

|

|

141

|

|

Natural Gas Distribution Segment

Natural Gas Distribution segment net loss increased $1.2 million (or $0.04 per share) primarily reflecting higher operations and maintenance and depreciation expenses, partially offset by new rates in Oregon as a result of a general rate case, which was effective beginning Nov. 1, 2020.

Margin increased $4.1 million reflecting new rates in Oregon and customer growth, which collectively contributed $3.7 million.

Operations and maintenance expense increased $3.8 million as a result of higher expenses mainly from contractor and professional service fees for information technology, higher lease expense associated with our new headquarters and operations center, and a comparative benefit related to recording the year-to-date COVID deferral in the third quarter of 2020. Depreciation expense and general taxes increased $1.8 million related to higher property, plant, and equipment as we continue to invest in our system.

YEAR-TO-DATE RESULTS

The following financial comparisons are for the first nine months of 2021 and 2020 with individual year-over-year drivers below presented on an after-tax basis using a statutory tax rate of 26.5% unless otherwise noted.

NW Natural Holdings' year-to-date results are summarized by business segment in the table below:

|

|

Nine Months Ended September 30,

|

|

|

2021

|

|

2020

|

|

Change

|

In thousands, except per share data

|

|

Amount

|

|

Per Share

|

|

Amount

|

|

Per Share

|

|

Amount

|

|

Per Share

|

Net income from continuing operations:

|

|

|

|

|

|

|

|

|

|

|

|

|

Natural Gas Distribution segment

|

|

$

|

29,247

|

|

|

$

|

0.95

|

|

|

$

|

19,476

|

|

|

$

|

0.64

|

|

|

$

|

9,771

|

|

|

$

|

0.31

|

|

Other

|

|

8,891

|

|

|

0.29

|

|

|

4,991

|

|

|

0.16

|

|

|

3,900

|

|

|

0.13

|

|

Consolidated

|

|

$

|

38,138

|

|

|

$

|

1.24

|

|

|

$

|

24,467

|

|

|

$

|

0.80

|

|

|

$

|

13,671

|

|

|

$

|

0.44

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted Shares

|

|

|

|

30,708

|

|

|

|

|

30,575

|

|

|

|

|

133

|

|

Natural Gas Distribution Segment

Natural Gas Distribution segment net income increased $9.8 million (or $0.31 per share) primarily reflecting new rates in Oregon as a result of a general rate case, which was effective beginning Nov. 1, 2020.

Margin increased $26.2 million reflecting new rates in Oregon and customer growth, which collectively contributed $27.3 million. This was partially offset by a net $1.1 million loss primarily from the gas cost incentive sharing mechanism as a result of purchasing higher priced gas during a February 2021 cold weather event than what was forecasted for the year in part offset by favorable weather.

Operations and maintenance expense increased $8.5 million as a result of higher expenses mainly from increased employee compensation and benefit costs, higher lease expense associated with our new headquarters and operations center, and contractor, professional service fees and license costs related to information technology system upgrades. Depreciation expense and general taxes increased $7.3 million related to higher property, plant, and equipment as we continue to invest in our system.

Other

Other net income increased $3.9 million (or $0.13 per share) reflecting $5.7 million of higher net income from NW Natural's other activities offset by a loss of $1.8 million from NW Natural Holdings' other activities. For NW Natural, the benefit in other activities was primarily driven by higher asset management revenues from a February 2021 weather event. NW Natural Holding's other activities reported higher costs at the holding company.

BALANCE SHEET AND CASH FLOWS

During the first nine months of 2021, the Company generated $181.7 million in operating cash flows or an increase of $30.9 million compared to the same period in 2020 due to higher net income and lower net working capital requirements. The Company used $203.5 million in investing activities during the first nine months of 2021 primarily for natural gas utility capital expenditures, compared to $226.8 million used in investing activities during the same period in 2020 for utility capital expenditures and the acquisition of several water and wastewater utilities. Net cash provided by financing activities was $14.0 million for the first nine months of 2021. As of September 30, 2021, NW Natural Holdings held cash of $19.5 million.

2021 GUIDANCE

NW Natural Holdings reaffirmed 2021 earnings guidance in the range of $2.40 to $2.60 per share. This guidance assumes continued customer growth, average weather conditions, and no significant changes in prevailing regulatory policies, mechanisms, or outcomes, or significant local, state or federal laws, legislation or regulations.

DIVIDEND DECLARED

The Board of Directors of NW Natural Holdings declared a quarterly dividend of $0.4825 per share on the Company’s common stock. The dividend is payable on Nov. 15, 2021 to shareholders of record on Oct. 29, 2021, reflecting an annual indicated dividend rate of $1.93 per share. Future dividends are subject to Board of Director discretion and approval.

CONFERENCE CALL AND WEBCAST

As previously announced, NW Natural Holdings will host a conference call and webcast today to discuss its third quarter 2021 financial and operating results.

Date and Time:

|

|

Friday, Nov. 5, 2021

|

|

|

8 a.m. PT (11 a.m. ET)

|

Phone Numbers:

|

|

United States: 1-866-267-6789

|

|

|

Canada: 1-855-669-9657

|

|

|

International: 1-412-902-4110

|

The call will also be webcast in a listen-only format for the media and general public and can be accessed at ir.nwnaturalholdings.com. A replay of the conference call will be available on our website and by dialing 1-877-344-7529 (U.S.), 1-855-669-9658 (Canada), and 1-412-317-0088 (international). The replay access code is 10154467.

ABOUT NW NATURAL HOLDINGS

Northwest Natural Holding Company, (NYSE: NWN) (NW Natural Holdings), is headquartered in Portland, Oregon and has been doing business for over 160 years in the Pacific Northwest. It owns NW Natural Gas Company (NW Natural), NW Natural Renewables Holdings (NW Natural Renewables), NW Natural Water Company (NW Natural Water), and other business interests. We have a longstanding commitment to safety, environmental stewardship and the energy transition, and taking care of our employees and communities.

NW Natural is a local distribution company that currently provides natural gas service to approximately 2.5 million people in more than 140 communities through more than 780,000 meters in Oregon and Southwest Washington with one of the most modern pipeline systems in the nation. NW Natural consistently leads the industry with high J.D. Power & Associates customer satisfaction scores. NW Natural owns and operates 20 Bcf of underground gas storage capacity in Oregon.

NW Natural Water provides water distribution and wastewater services to communities throughout the Pacific Northwest and Texas. NW Natural Water currently serves approximately 66,000 people through about 27,200 connections. Learn more about our water business at nwnaturalwater.com.

Additional information is available at nwnaturalholdings.com.

Forward-Looking Statements

This report, and other presentations made by NW Holdings from time to time, may contain forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as "anticipates," "assumes," "intends," "plans," "seeks," "believes," "estimates," "expects" and similar references to future periods. Examples of forward-looking statements include, but are not limited to, statements regarding the following: plans, objectives, assumptions, estimates, expectations, timing, goals, strategies, commitments, future events, investments, capital expenditures, targeted capital structure, risks, risk profile, stability, acquisitions and timing, completion and integration thereof, the likelihood and success associated with any transaction, utility system and infrastructure investments, system modernization, reliability and resiliency, global, national and local economies, customer and business growth, customer satisfaction ratings, weather, performance and service during weather events, customer rates or rate recovery and the timing and magnitude of potential rate changes, environmental remediation cost recoveries, environmental initiatives, decarbonization and the role of natural gas and the gas delivery system, including decarbonization goals and timelines, energy efficiency measures, use of renewable sources, renewable natural gas purchases, projects or investments and timing, magnitude and completion thereof, renewable hydrogen projects or investments and timing, magnitude and completion thereof, procurement of renewable natural gas or hydrogen for customers, technology and policy innovations, strategic goals and visions, the water and wastewater acquisition and investment strategy and financial effects of water and wastewater acquisitions, diversity, equity and inclusion initiatives, operating plans of third parties, financial results, including estimated income, availability and sources of liquidity, expenses, positions, revenues, returns, cost of capital, timing, and earnings and earnings guidance, dividends, commodity costs and sourcing asset management activities, performance, timing, outcome, or effects of regulatory proceedings or mechanisms or approvals, regulatory prudence reviews, anticipated regulatory actions or filings, accounting treatment of future events, effects of legislation or changes in laws or regulations, effects, extent, severity and duration of COVID-19 and resulting economic disruption, the impact of mitigating factors and other efforts to mitigate risks posed by its spread, ability of our workforce, customers or suppliers to operate or conduct business, COVID-19 financial impact, expenses, cost savings measures and cost recovery including through regulatory deferrals and the timing and magnitude thereof, impact on capital projects, governmental actions and timing thereof, including actions to reopen the economy, and other statements that are other than statements of historical facts.

Forward-looking statements are based on current expectations and assumptions regarding its business, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. Actual results may differ materially from those contemplated by the forward-looking statements. You are therefore cautioned against relying on any of these forward-looking statements. They are neither statements of historical fact nor guarantees or assurances of future operational, economic or financial performance. Important factors that could cause actual results to differ materially from those in the forward-looking statements are discussed by reference to the factors described in Part I, Item 1A "Risk Factors", and Part II, Item 7 and Item 7A "Management's Discussion and Analysis of Financial Condition and Results of Operations" and "Quantitative and Qualitative Disclosure about Market Risk" in the most recent Annual Report on Form 10-K and in Part I, Items 2 and 3 "Management's Discussion and Analysis of Financial Condition and Results of Operations" and "Quantitative and Qualitative Disclosures About Market Risk", and Part II, Item 1A, "Risk Factors", in the quarterly reports filed thereafter.

All forward-looking statements made in this report and all subsequent forward-looking statements, whether written or oral and whether made by or on behalf of NW Holdings or NW Natural, are expressly qualified by these cautionary statements. Any forward-looking statement speaks only as of the date on which such statement is made, and NW Holdings and NW Natural undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law. New factors emerge from time to time and it is not possible to predict all such factors, nor can it assess the impact of each such factor or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statements.

NORTHWEST NATURAL HOLDINGS

|

Consolidated Income Statement and Financial Highlights (Unaudited)

|

Third Quarter 2021

|

|

|

Three Months Ended

|

|

|

|

Nine Months Ended

|

|

|

|

Twelve Months Ended

|

|

|

| In thousands, except per share amounts, |

|

September 30,

|

|

|

|

September 30,

|

|

|

|

September 30,

|

|

|

| customer, and degree day data |

|

2021

|

|

2020

|

|

Change

|

|

2021

|

|

2020

|

|

Change

|

|

2021

|

|

2020

|

|

Change

|

Operating revenues

|

|

$

|

101,447

|

|

|

$

|

93,284

|

|

|

9%

|

|

$

|

566,310

|

|

|

$

|

513,406

|

|

|

10%

|

|

$

|

826,583

|

|

|

$

|

760,670

|

|

|

9%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of gas

|

|

25,266

|

|

|

23,741

|

|

|

6

|

|

178,669

|

|

|

173,489

|

|

|

3

|

|

267,935

|

|

|

265,233

|

|

|

1

|

Operations and maintenance

|

|

47,329

|

|

|

41,352

|

|

|

14

|

|

149,567

|

|

|

134,256

|

|

|

11

|

|

195,440

|

|

|

180,593

|

|

|

8

|

Environmental remediation

|

|

806

|

|

|

867

|

|

|

(7)

|

|

6,092

|

|

|

6,494

|

|

|

(6)

|

|

9,289

|

|

|

11,573

|

|

|

(20)

|

General taxes

|

|

9,061

|

|

|

8,656

|

|

|

5

|

|

29,344

|

|

|

26,924

|

|

|

9

|

|

37,498

|

|

|

34,413

|

|

|

9

|

Revenue taxes

|

|

3,891

|

|

|

3,555

|

|

|

9

|

|

22,226

|

|

|

19,752

|

|

|

13

|

|

32,765

|

|

|

30,121

|

|

|

9

|

Depreciation and amortization

|

|

28,438

|

|

|

25,934

|

|

|

10

|

|

84,679

|

|

|

76,445

|

|

|

11

|

|

111,917

|

|

|

100,607

|

|

|

11

|

Other operating expenses

|

|

1,047

|

|

|

767

|

|

|

37

|

|

2,794

|

|

|

2,246

|

|

|

24

|

|

4,249

|

|

|

3,365

|

|

|

26

|

Total operating expenses

|

|

115,838

|

|

|

104,872

|

|

|

10

|

|

473,371

|

|

|

439,606

|

|

|

8

|

|

659,093

|

|

|

625,905

|

|

|

5

|

Income (loss) from operations

|

|

(14,391

|

)

|

|

(11,588

|

)

|

|

24

|

|

92,939

|

|

|

73,800

|

|

|

26

|

|

167,490

|

|

|

134,765

|

|

|

24

|

Other income (expense), net

|

|

(2,216

|

)

|

|

(3,287

|

)

|

|

(33)

|

|

(8,355

|

)

|

|

(9,902

|

)

|

|

(16)

|

|

(12,397

|

)

|

|

(13,956

|

)

|

|

(11)

|

Interest expense, net

|

|

11,175

|

|

|

9,165

|

|

|

22

|

|

33,329

|

|

|

32,339

|

|

|

3

|

|

44,042

|

|

|

43,217

|

|

|

2

|

Income (loss) before income taxes

|

|

(27,782

|

)

|

|

(24,040

|

)

|

|

16

|

|

51,255

|

|

|

31,559

|

|

|

62

|

|

111,051

|

|

|

77,592

|

|

|

43

|

Income tax expense (benefit)

|

|

(7,127

|

)

|

|

(5,363

|

)

|

|

33

|

|

13,117

|

|

|

7,092

|

|

|

85

|

|

27,107

|

|

|

14,777

|

|

|

83

|

Net income (loss) from continuing operations

|

|

(20,655

|

)

|

|

(18,677

|

)

|

|

11

|

|

38,138

|

|

|

24,467

|

|

|

56

|

|

83,944

|

|

|

62,815

|

|

|

34

|

Income (loss) from discontinued operations, net of tax

|

|

—

|

|

|

765

|

|

|

(100)

|

|

—

|

|

|

267

|

|

|

(100)

|

|

6,241

|

|

|

(1,341

|

)

|

|

(565)

|

Net income (loss)

|

|

$

|

(20,655

|

)

|

|

$

|

(17,912

|

)

|

|

15

|

|

$

|

38,138

|

|

|

$

|

24,734

|

|

|

54

|

|

$

|

90,185

|

|

|

$

|

61,474

|

|

|

47

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common shares outstanding:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average diluted for period

|

|

30,696

|

|

|

30,555

|

|

|

|

|

30,708

|

|

|

30,575

|

|

|

|

|

30,676

|

|

|

30,551

|

|

|

|

End of period

|

|

30,730

|

|

|

30,565

|

|

|

|

|

30,730

|

|

|

30,565

|

|

|

|

|

30,730

|

|

|

30,565

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Per share of common stock information:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted earnings (loss) from continuing operations

|

|

$

|

(0.67

|

)

|

|

$

|

(0.61

|

)

|

|

|

|

$

|

1.24

|

|

|

$

|

0.80

|

|

|

|

|

$

|

2.74

|

|

|

$

|

2.06

|

|

|

|

Diluted earnings (loss) from discontinued operations, net of tax

|

|

—

|

|

|

0.02

|

|

|

|

|

—

|

|

|

0.01

|

|

|

|

|

0.20

|

|

|

(0.05

|

)

|

|

|

Diluted earnings (loss)

|

|

(0.67

|

)

|

|

(0.59

|

)

|

|

|

|

1.24

|

|

|

0.81

|

|

|

|

|

2.94

|

|

|

2.01

|

|

|

|

Dividends paid per share

|

|

0.4800

|

|

|

0.4775

|

|

|

|

|

1.4400

|

|

|

1.4325

|

|

|

|

|

1.9200

|

|

|

1.9100

|

|

|

|

Book value, end of period

|

|

29.01

|

|

|

27.90

|

|

|

|

|

29.01

|

|

|

27.90

|

|

|

|

|

29.01

|

|

|

27.90

|

|

|

|

Market closing price, end of period

|

|

45.99

|

|

|

45.39

|

|

|

|

|

45.99

|

|

|

45.39

|

|

|

|

|

45.99

|

|

|

45.39

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital structure, end of period:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common stock equity

|

|

40.4

|

%

|

|

42.0

|

%

|

|

|

|

40.4

|

%

|

|

42.0

|

%

|

|

|

|

40.4

|

%

|

|

42.0

|

%

|

|

|

Long-term debt

|

|

41.5

|

%

|

|

42.3

|

%

|

|

|

|

41.5

|

%

|

|

42.3

|

%

|

|

|

|

41.5

|

%

|

|

42.3

|

%

|

|

|

Short-term debt (including current maturities of long-term debt)

|

|

18.1

|

%

|

|

15.7

|

%

|

|

|

|

18.1

|

%

|

|

15.7

|

%

|

|

|

|

18.1

|

%

|

|

15.7

|

%

|

|

|

Total

|

|

100.0

|

%

|

|

100.0

|

%

|

|

|

|

100.0

|

%

|

|

100.0

|

%

|

|

|

|

100.0

|

%

|

|

100.0

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Natural Gas Distribution segment operating statistics:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Meters - end of period

|

|

781,727

|

|

|

769,817

|

|

|

1.5%

|

|

781,727

|

|

|

769,817

|

|

|

1.5%

|

|

781,727

|

|

|

769,817

|

|

|

1.5%

|

Volumes in therms:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Residential and commercial sales

|

|

55,597

|

|

|

54,124

|

|

|

|

|

455,888

|

|

|

440,811

|

|

|

|

|

692,348

|

|

|

694,171

|

|

|

|

Industrial sales and transportation

|

|

105,632

|

|

|

100,312

|

|

|

|

|

350,175

|

|

|

341,755

|

|

|

|

|

474,046

|

|

|

473,741

|

|

|

|

Total volumes sold and delivered

|

|

161,229

|

|

|

154,436

|

|

|

|

|

806,063

|

|

|

782,566

|

|

|

|

|

1,166,394

|

|

|

1,167,912

|

|

|

|

Operating revenues:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Residential and commercial sales

|

|

$

|

71,979

|

|

|

$

|

66,384

|

|

|

|

|

$

|

470,923

|

|

|

$

|

431,187

|

|

|

|

|

$

|

701,082

|

|

|

$

|

650,569

|

|

|

|

Industrial sales and transportation

|

|

14,000

|

|

|

12,334

|

|

|

|

|

45,472

|

|

|

42,195

|

|

|

|

|

61,955

|

|

|

58,237

|

|

|

|

Other distribution revenues

|

|

292

|

|

|

639

|

|

|

|

|

1,278

|

|

|

1,607

|

|

|

|

|

1,597

|

|

|

1,964

|

|

|

|

Other regulated services

|

|

4,771

|

|

|

4,404

|

|

|

|

|

14,321

|

|

|

14,251

|

|

|

|

|

19,192

|

|

|

18,910

|

|

|

|

Total operating revenues

|

|

91,042

|

|

|

83,761

|

|

|

|

|

531,994

|

|

|

489,240

|

|

|

|

|

783,826

|

|

|

729,680

|

|

|

|

Less: Cost of gas

|

|

25,322

|

|

|

23,797

|

|

|

|

|

178,837

|

|

|

173,657

|

|

|

|

|

268,160

|

|

|

265,457

|

|

|

|

Less: Environmental remediation expense

|

|

806

|

|

|

867

|

|

|

|

|

6,092

|

|

|

6,494

|

|

|

|

|

9,289

|

|

|

11,573

|

|

|

|

Less: Revenue taxes

|

|

3,838

|

|

|

3,555

|

|

|

|

|

22,143

|

|

|

19,752

|

|

|

|

|

32,682

|

|

|

30,121

|

|

|

|

Margin, net

|

|

$

|

61,076

|

|

|

$

|

55,542

|

|

|

|

|

$

|

324,922

|

|

|

$

|

289,337

|

|

|

|

|

$

|

473,695

|

|

|

$

|

422,529

|

|

|

|

Degree days:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average (25-year average)

|

|

9

|

|

|

9

|

|

|

|

|

1,640

|

|

|

1,659

|

|

|

|

|

2,687

|

|

|

2,723

|

|

|

|

Actual

|

|

4

|

|

|

2

|

|

|

100%

|

|

1,447

|

|

|

1,406

|

|

|

3%

|

|

2,425

|

|

|

2,477

|

|

|

(2)%

|

Percent colder (warmer) than average weather

|

|

(56

|

)%

|

|

(78

|

)%

|

|

|

|

(12

|

)%

|

|

(15

|

)%

|

|

|

|

(10

|

)%

|

|

(9

|

)%

|

|

|

Contacts

Investor Contact:

Nikki Sparley

Phone: 503-721-2530

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

Media Contact:

David Roy

Phone: 503-610-7157

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

Read full story here