The first major study of oil and gas workforce perceptions since the start of the global downturn has revealed which operators and service companies are rated highest by oil and gas professionals based on key issues including values, performance and pay rates.

The first major study of oil and gas workforce perceptions since the start of the global downturn has revealed which operators and service companies are rated highest by oil and gas professionals based on key issues including values, performance and pay rates.

Shell, Chevron, ExxonMobil, BP and Halliburton make up the top five in the wide-ranging Ideal Employer Survey 2016, undertaken by Rigzone, which attracted responses from 8,400 people in more than 100 countries.

More than 3,000 oil and gas industry companies were named in the survey, published today, and despite the challenges faced by the sector through the depression in the oil price, no companies from other industries were ranked in the top 30.

The research, the first of its kind in the sector, was carried out between July and September this year, ranking companies based on 19 questions focused on their qualities and rating their ideal employers.

Commitment to health and safety is the single most important attribute (securing 90%) for people in the upstream, midstream and downstream sectors worldwide. Competitive salary, interesting and challenging work, and corporate integrity (all 88%) were equal second, with workplace culture, and training and development programs (87%) joint third.

Regionally, only respondents in North America and Europe chose factors other than safety as their top priority. Salary, and manages business with integrity were joint top for North America, and the focus was on ‘interesting/challenging work’ for Europe.

James Bennett, Rigzone managing director said: “The results are revealing as this is the first major survey to be conducted with the global workforce, and against a background of continuing challenging economic circumstances for the sector.

“That the largest companies in the sector complete the top 30, the majority having undergone significant change due to the effects of the downturn in the past 18 months, will give them confidence that the workforce remain committed to the sector.”

On coming first in the survey, Jonathan Kohn, Shell HR VP for the UK, Ireland, Nordics and South Africa said: “Shell people are our strongest ambassadors and we are proud of the quality of the people that we've got. I think it's pretty clear and central to the group's strategy that having that access to quality people really is part of how we compete to win.”

The supermajor continues to invest in the development of the industry’s future workforce, and reiterated its desire to continue to bring new blood to the sector through graduate recruitment. Kohn added: "We have made a strong commitment to try to maintain our graduate recruitment through the whole cycle. We typically recruit in the range of 800 to 1,100 graduates per year around the world. We are at the bottom end of that range at the moment… But that is still a very substantial commitment.”

James Bennett, said, “It is no surprise that health and safety is the overwhelming priority across the majority of respondents, but no-less reassuring for an industry which continues to put people first in all aspects of E&P and downstream activity. Across the industry, new challenges continue to emerge - companies that can best adapt to the current environment and take advantage of new technology will be most attractive to professionals looking for interesting and rewarding work. Ensuring that the working environment, from the perspective of corporate culture and integrity, remains attractive and continues to garner respect is an area where organizations will need to ensure they do not become complacent after these positive results.”

Link to the Ideal Employer survey

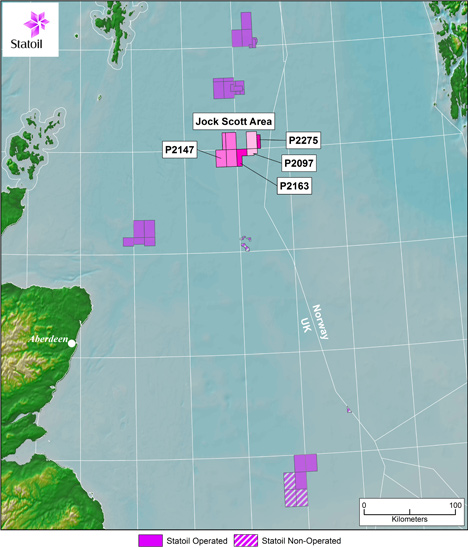

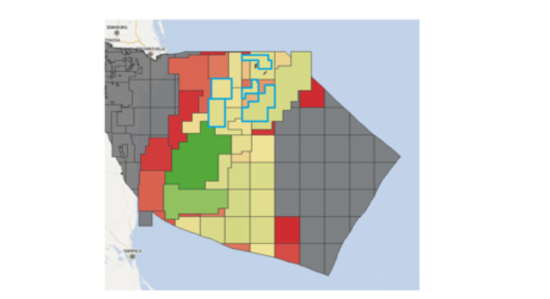

Map Image credit: Statoil

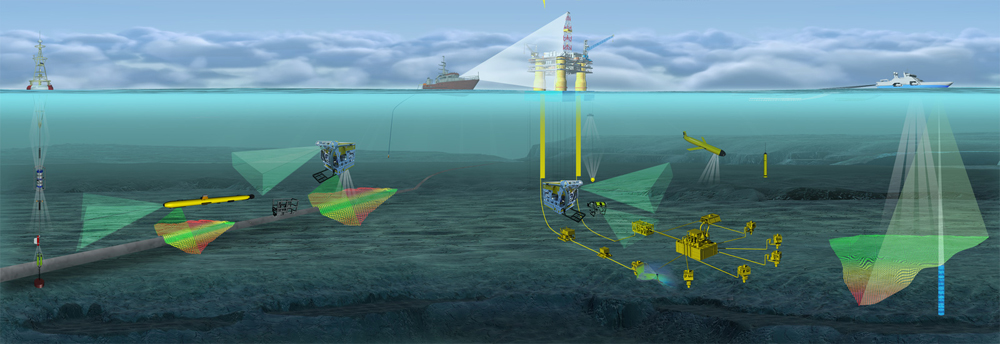

Map Image credit: Statoil Danos has successfully completed the fabrication of three boarding valve skids and one service line skid for Shell Offshore Inc.’s (Shell) deep-water Appomattox facility. Requiring approximately 12 months to complete, the project engaged four Danos service lines, including project management, fabrication, coatings, and automation.

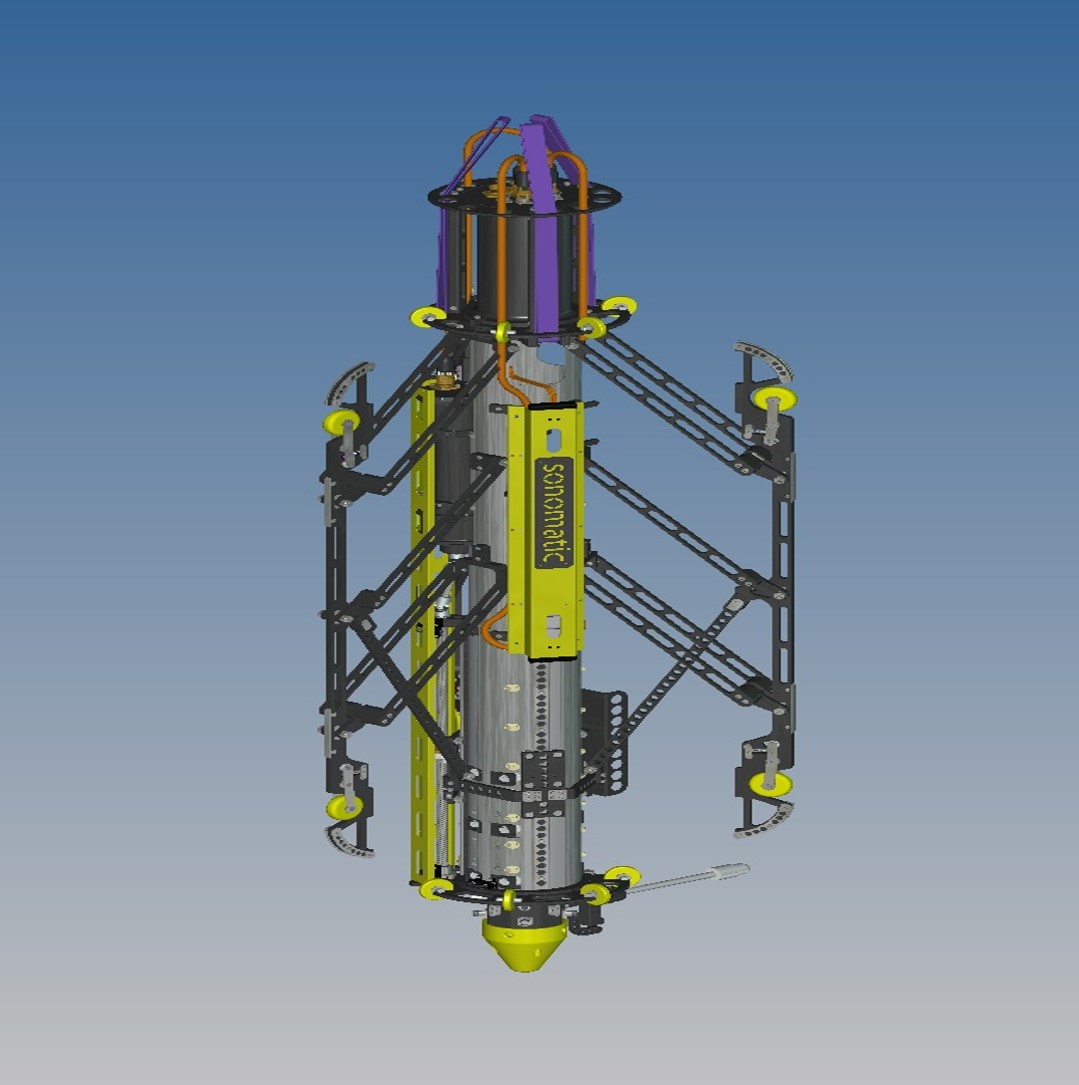

Danos has successfully completed the fabrication of three boarding valve skids and one service line skid for Shell Offshore Inc.’s (Shell) deep-water Appomattox facility. Requiring approximately 12 months to complete, the project engaged four Danos service lines, including project management, fabrication, coatings, and automation. Image courtesy: Sonomatic

Image courtesy: Sonomatic

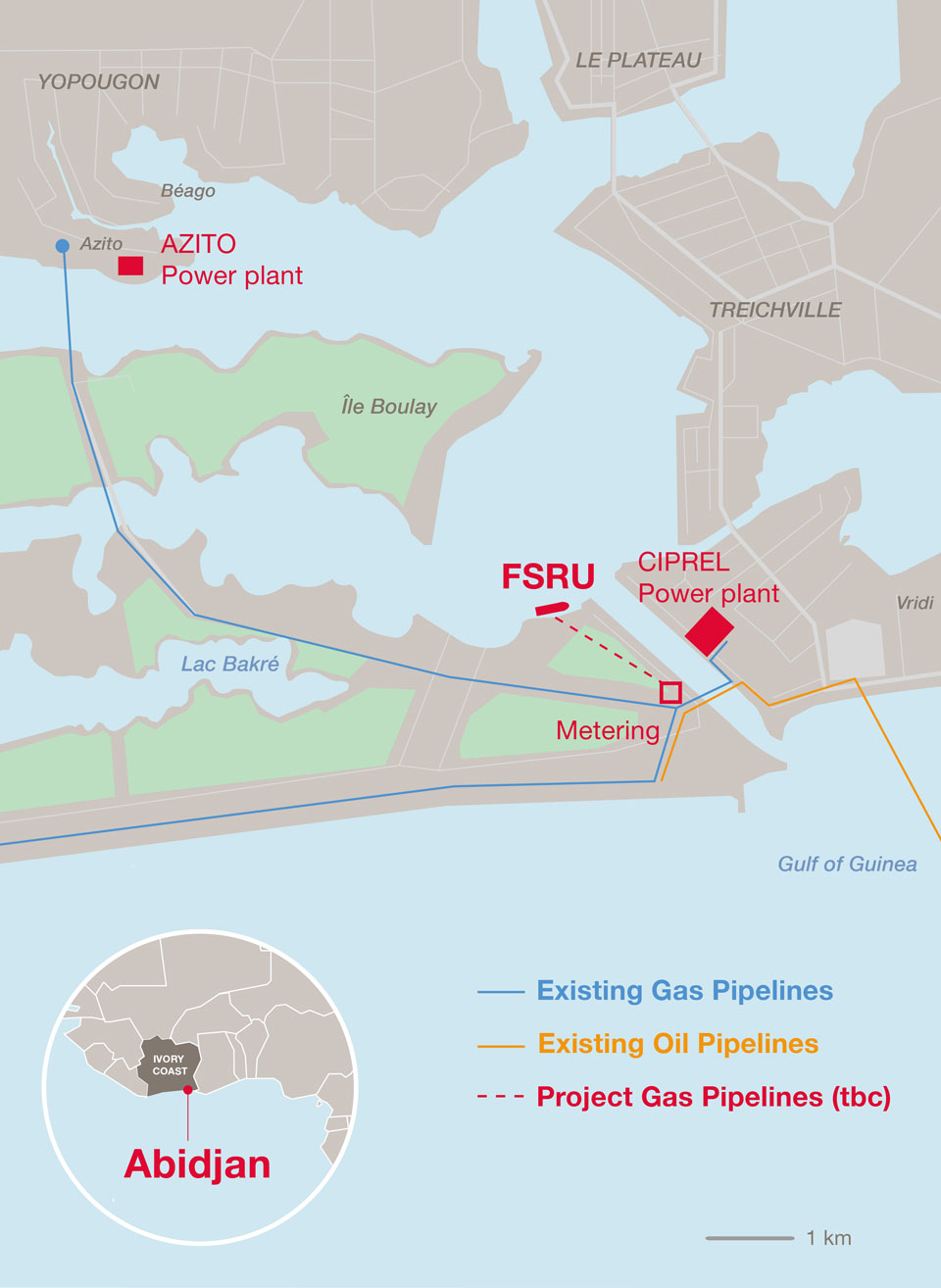

The decision announced by the Government of the Ivory Coast on October 4th was followed by the signature of the shareholders’ agreement in Abidjan between Total, which will operate the project with a 34% interest, national companies PetroCI (11%) and CI Energies (5%) as well as SOCAR (26%), Shell (13%), Golar (6%) and Endeavor Energy (5%).

The decision announced by the Government of the Ivory Coast on October 4th was followed by the signature of the shareholders’ agreement in Abidjan between Total, which will operate the project with a 34% interest, national companies PetroCI (11%) and CI Energies (5%) as well as SOCAR (26%), Shell (13%), Golar (6%) and Endeavor Energy (5%). The first major study of oil and gas workforce perceptions since the start of the global downturn has revealed which operators and service companies are rated highest by oil and gas professionals based on key issues including values, performance and pay rates.

The first major study of oil and gas workforce perceptions since the start of the global downturn has revealed which operators and service companies are rated highest by oil and gas professionals based on key issues including values, performance and pay rates. Photo credit: DonaldJTrump.com

Photo credit: DonaldJTrump.com Subsea 7 S.A.

Subsea 7 S.A.

Technip’s

Technip’s Jacobs Engineering Group Inc.

Jacobs Engineering Group Inc.

David Knukkel, Director of RIMS BV demonstrating the Elios Drone. Photo credit: RIMS BV

David Knukkel, Director of RIMS BV demonstrating the Elios Drone. Photo credit: RIMS BV