Crude Oil:

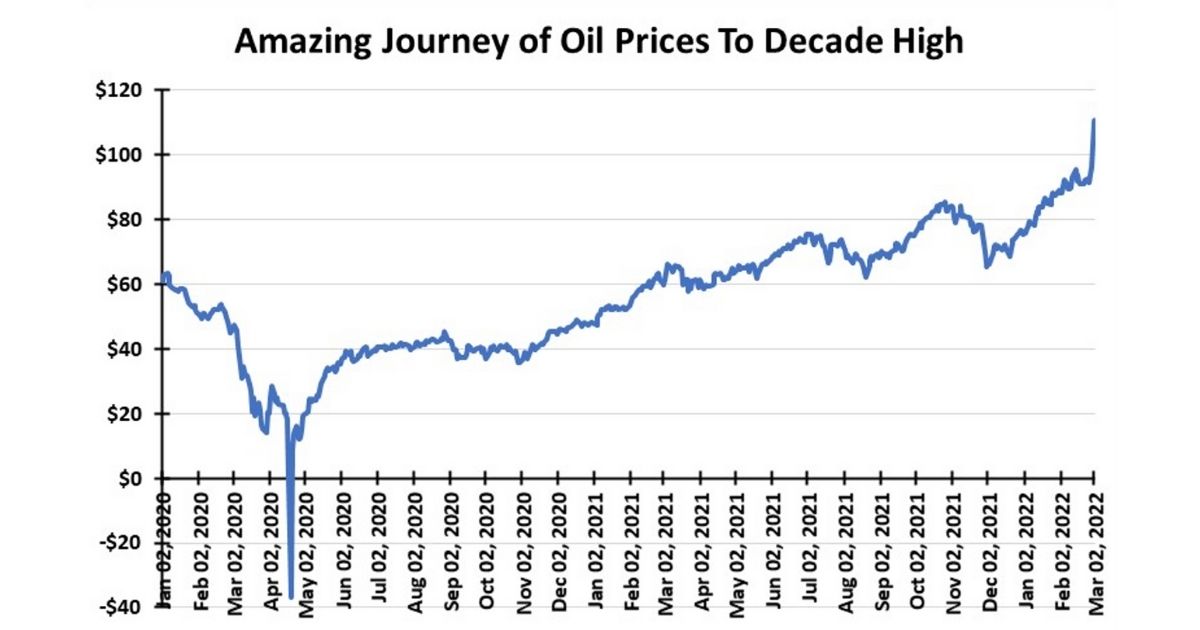

$100+ per barrel of oil. Wow! The oil market finally delivered on prior forecasts for that threshold being reached this year. However, it took the invasion of Ukraine by Vladimir Putin’s Russian troops to make it happen, not merely tight supply and strong demand. Obviously, there is some “war risk” premium in that price—but just how much? We will only know when the war is over, and some semblance of geopolitical normalcy returns—but no one can offer a timetable for that to happen.

Amid the unfolding Russia-Ukrainian conflict, the global oil market is in backwardation

Currently, the global oil market is in backwardation. That is when near-term barrels are valued more highly than those to be delivered in the future. In effect, the market is saying it prizes the immediate availability of barrels more than it worries about future supply/demand balances. The reason for backwardation is simple—Russia produces about 10 million barrels of crude oil per day, or roughly 10 percent of the world’s output. It is among the top three global suppliers, along with the U.S. and Saudi Arabia. Of Russia’s output, it consumes about half and exports the balance, including selling about 600,000 barrels per day to the U.S. Interestingly, in 2020, California refineries purchased 15 million barrels of Russian oil, something being highlighted in the debate over Governor Gavin Newsom shutting down oil drilling and production in the state.

The alignment of western countries against Russia, as reflected in the global financial sanctions, has yet to impact Russia’s oil sales, but the population of potential buyers is shrinking due to the obstacles created by the financial sanctions in paying for the oil. Oil is priced and paid in U.S. dollars. There are financial workarounds that will be engineered, and Russia still has the explicit and implicit support of a handful of nations who use oil, principally China. (China is also a significant buyer of Russian natural gas and coal.) But these challenges are pushing oil prices higher.

The alignment of western countries against Russia, as reflected in the global financial sanctions, has yet to impact Russia’s oil sales, but the population of potential buyers is shrinking due to the obstacles created by the financial sanctions in paying for the oil. Oil is priced and paid in U.S. dollars. There are financial workarounds that will be engineered, and Russia still has the explicit and implicit support of a handful of nations who use oil, principally China. (China is also a significant buyer of Russian natural gas and coal.) But these challenges are pushing oil prices higher.

Western governments are reluctant to sanction the purchase and use of Russian fossil fuels for the simple reason that we learned in the 1970s—twice—that if you suddenly remove a chunk of global oil supply, prices spike and economies sink. This is called shooting yourself in the foot!

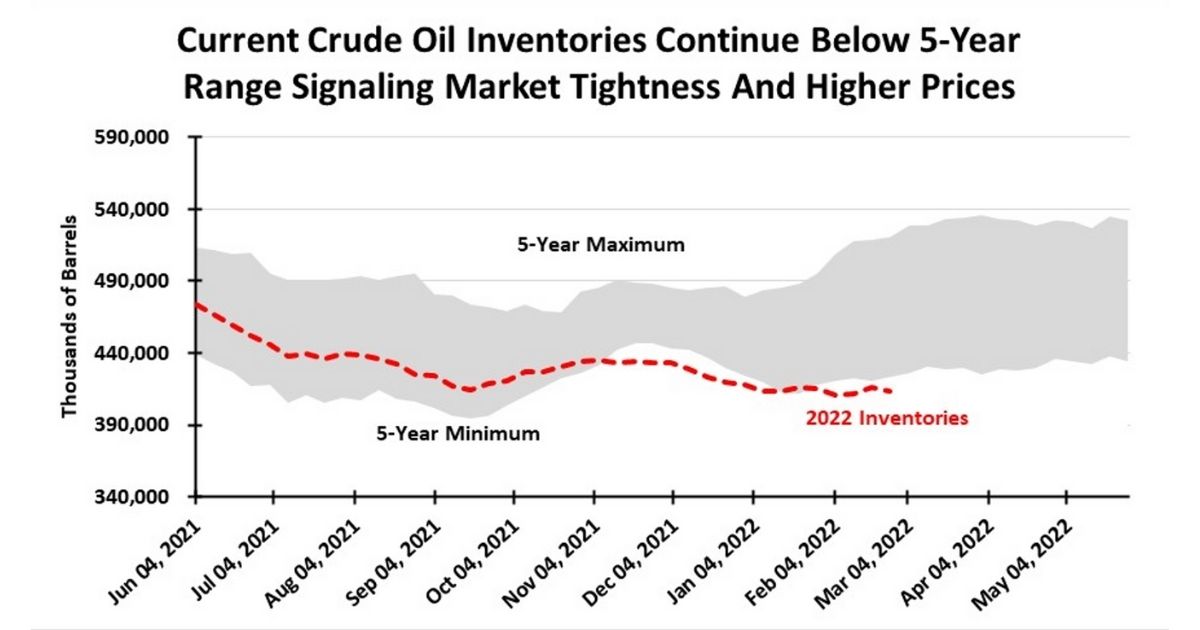

Before Ukraine erupted, global oil markets were tightening as demand continued to grow faster than originally envisioned coming out of the pandemic. At the same time, supply growth has proven less robust as various OPEC members struggle with operational challenges while U.S. oil companies limit capital spending in adherence to financial discipline demands from investors. OPEC+ has just indicated it will not deviate from its plan to add only 400,000 barrels per day monthly back into the world’s supply, at the same time capital markets reward oil producers who hold firm to their spending throttle. The result will be elevated, or possibly higher, oil prices until either economic activity craters, a resolution of the Russia-Ukraine war is found, or another supply source emerges such as Iranian oil.

Before Ukraine erupted, global oil markets were tightening as demand continued to grow faster than originally envisioned coming out of the pandemic. At the same time, supply growth has proven less robust as various OPEC members struggle with operational challenges while U.S. oil companies limit capital spending in adherence to financial discipline demands from investors. OPEC+ has just indicated it will not deviate from its plan to add only 400,000 barrels per day monthly back into the world’s supply, at the same time capital markets reward oil producers who hold firm to their spending throttle. The result will be elevated, or possibly higher, oil prices until either economic activity craters, a resolution of the Russia-Ukraine war is found, or another supply source emerges such as Iranian oil.

U.S. LNG is in high demand from European governments

Natural Gas

Anymore cold weather? If not, the natural gas market is all about liquefied natural gas (LNG) shipments to Europe and producer willingness to boost gas drilling, i.e., boosting supply.

We are in the last month of winter demand, assuming Mother Nature does not have more cold and snow in her bag of tricks. Therefore, we will likely see gas prices reflect long-term gas market trends, which revolve around LNG’s future output and domestic gas use in a low carbon economy. The Biden administration’s embrace of climate as the standard for all its policy decisions has weaponized the bureaucracy to fight any deviation from restrictive energy policies.

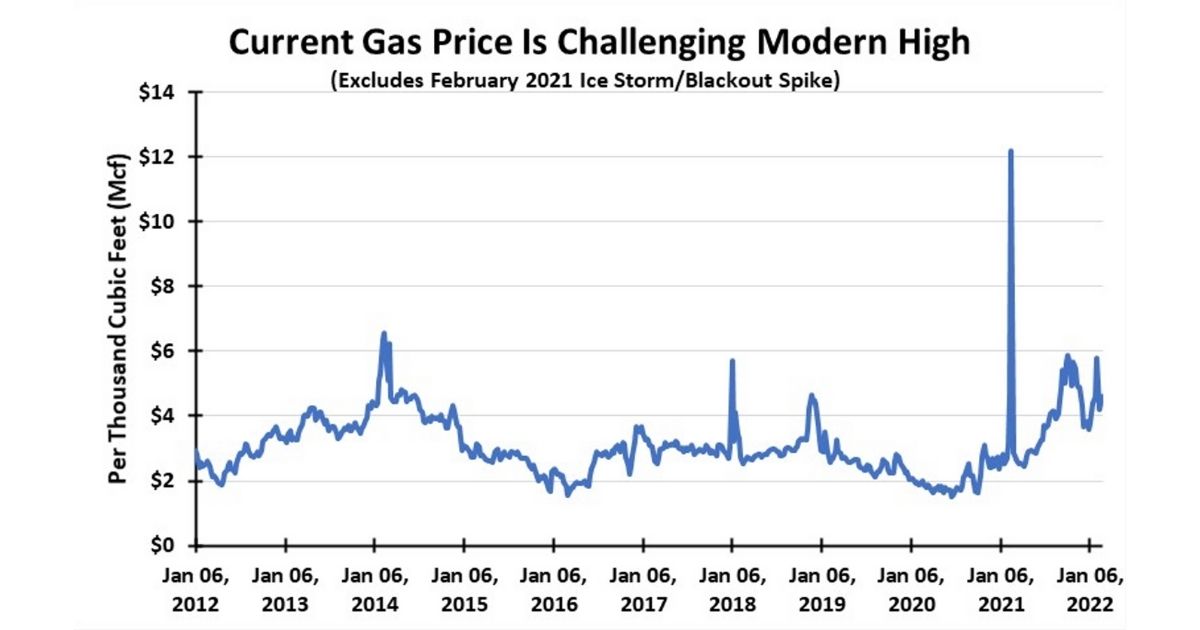

Telling the Supreme Court that the EPA’s regulating carbon emissions under obscure provisions of the law is not a “major question” under the court’s purview is the latest move to prevent intervention against the climate change movement. FERC’s declaration that it will consider downstream carbon emissions when evaluating new pipeline permits and the Interior Department’s decision to not appeal a federal judge’s invalidation of the most recent offshore Gulf of Mexico lease sale, throwing the 5-year offshore lease plan into question, are further examples of government actions crippling our domestic petroleum industry. These steps, at a time when oil is over $100 a barrel and natural gas nears $5 per thousand cubic feet, counter the Biden administration’s claim it is working to reduce inflation for the average American family.

Telling the Supreme Court that the EPA’s regulating carbon emissions under obscure provisions of the law is not a “major question” under the court’s purview is the latest move to prevent intervention against the climate change movement. FERC’s declaration that it will consider downstream carbon emissions when evaluating new pipeline permits and the Interior Department’s decision to not appeal a federal judge’s invalidation of the most recent offshore Gulf of Mexico lease sale, throwing the 5-year offshore lease plan into question, are further examples of government actions crippling our domestic petroleum industry. These steps, at a time when oil is over $100 a barrel and natural gas nears $5 per thousand cubic feet, counter the Biden administration’s claim it is working to reduce inflation for the average American family.

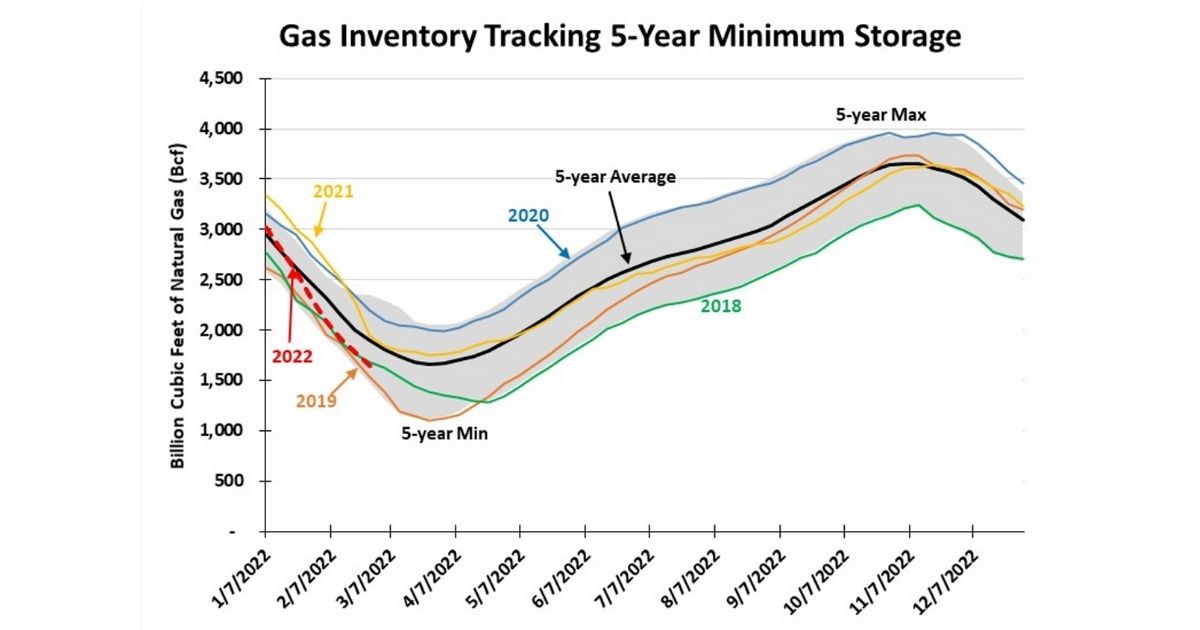

Rebuilding gas storage for next winter will be weighed alongside the opportunity to export more LNG to support Europe’s gas diversification efforts. With European governments needing to diversify their gas supplies—including Germany advocating building two new LNG terminals—America’s LNG will be in great demand. European governments fear Russia turning off its gas pipeline supply and devastating economies, therefore, they are begging for more U.S. LNG. There are reports of empty tankers waiting at terminals to load highly profitable cargos. That demand will moderate as winter transitions to spring and then summer, but the long-term case for U.S. LNG meeting European gas needs will remain solid. That demand will put a floor under domestic gas prices this spring, even if it is unseasonably warm.

U.S. gas producers remain reluctant to boost drilling aggressively to avoid being targeted for reverting to their old “capital destructive” ways. Will we need more supply? Yes. Will we get more supply? Yes. The issue for gas futures prices is at what pace we get the additional supply relative to the expansion in LNG export capacity and further shifts away from dirty fossil fuels in our power generation business that boost domestic gas use. March is a tricky time to forecast gas prices, but we know that fundamental supply/demand dynamics favor more demand amid a questionable supply growth outlook. That is a recipe for healthy natural gas prices for the foreseeable future.

U.S. gas producers remain reluctant to boost drilling aggressively to avoid being targeted for reverting to their old “capital destructive” ways. Will we need more supply? Yes. Will we get more supply? Yes. The issue for gas futures prices is at what pace we get the additional supply relative to the expansion in LNG export capacity and further shifts away from dirty fossil fuels in our power generation business that boost domestic gas use. March is a tricky time to forecast gas prices, but we know that fundamental supply/demand dynamics favor more demand amid a questionable supply growth outlook. That is a recipe for healthy natural gas prices for the foreseeable future.

By G. Allen Brooks, Expert Offshore Energy Analyst & ON&T Contributor