Hyperdynamics Corporation (OTCQX:HDYN) announces an impasse in plans to resume petroleum operations and move forward with drilling an exploratory well under the Joint Operating Agreement governing the oil and gas exploration rights offshore Guinea ("JOA"). The impasse reflects a refusal by the participants in the Guinea project, Tullow Guinea Ltd., ("Tullow") a wholly owned subsidiary of Tullow Oil, PLC and Dana Petroleum (E&P) Limited, ("Dana") a wholly owned subsidiary of the Korean National Oil Company, to meet their obligations under the JOA and the Production Sharing Contract with the Government of Guinea ("PSC").

Hyperdynamics Corporation (OTCQX:HDYN) announces an impasse in plans to resume petroleum operations and move forward with drilling an exploratory well under the Joint Operating Agreement governing the oil and gas exploration rights offshore Guinea ("JOA"). The impasse reflects a refusal by the participants in the Guinea project, Tullow Guinea Ltd., ("Tullow") a wholly owned subsidiary of Tullow Oil, PLC and Dana Petroleum (E&P) Limited, ("Dana") a wholly owned subsidiary of the Korean National Oil Company, to meet their obligations under the JOA and the Production Sharing Contract with the Government of Guinea ("PSC").

In August 2015, Tullow as operator under the JOA presented to Dana and Hyperdynamics, through its subsidiary, SCS Corporation Ltd. ("SCS"), a work program and budget to complete drilling of a well before the September 2016 deadline established by the PSC. Tullow and SCS voted in favor of the work program and budget, and it was deemed passed by this vote. On September 23, 2015, Tullow submitted this work program and budget to the Guinea Minister of Mines and Geology. Pursuant to Article 9.4 of the PSC, the annual work program and budget is deemed approved 30 days after submission, and that period has passed. Tullow also submitted a contracting strategy to the Guinea Government and initiated well preparation procedures that included visits to Guinea and meetings with Guinea government officials, all of which indicated that Tullow was on course to resume petroleum operations.

However, in an Operating Committee Meeting on November 18, 2015, in contrast to its prior actions, Tullow stated that it would not restart petroleum operations unless Dana agreed to fund its portion of well costs, which Dana declined to do.

Following Tullow's now withdrawn declaration of force majeure, both Dana and Tullow had raised concerns in 2014 that the Foreign Corrupt Practices Act investigations into Hyperdynamics could cause the Guinea government to question titles provided by the PSC. Notwithstanding the conclusion of those investigations, Dana maintained its position that it would not agree to fund well costs absent further assurances from the Guinea government that the Guinea government would not challenge ownership rights under the PSC. Since that November 18, 2015 meeting, Hyperdynamics has engaged in discussions with Tullow and Dana relating to these positions.

At a Petroleum Operations Management Committee in Guinea on December 16, 2015, Tullow and Hyperdynamics met with representatives of the Guinea Minister of Mines and Geology. Dana declined to attend the meeting. At the conclusion of those meetings on December 17th, the Guinea government agreed to the exact title assurances proposed by Dana, and agreed to by Tullow in previous communications, as an amendment to the PSC. At the meeting, Hyperdynamics executed the amendment and Tullow and the Ministry of Mines and Geology of Guinea initialed the document. Tullow committed to moving the amendment through the necessary approval processes at Tullow.

As of this date, neither Tullow nor Dana has signed the PSC amendment, and both have stated that they will not sign unless the other party signs first. Both have repeatedly refused to sign first, declined Hyperdynamics' suggestion that they sign simultaneously, and have refused to agree to restart petroleum operations.

Hyperdynamics believes that neither Tullow nor Dana has the ability under the JOA to block resumption of petroleum operations regardless of whether a PSC amendment was negotiated. In any event, the fact that the Guinea government agreed to the PSC amendment has removed any title concerns Tullow and Dana had about moving forward with the resumption of petroleum operations.

Ray Leonard, President and CEO, commented, "We are extremely disappointed in the actions of both Tullow and Dana. Dana stated that the only impediment to moving forward with petroleum operations was additional title assurances, but will not sign a document providing the exact assurances it sought. And, even though Tullow is the operator, it is refusing to take the required steps to move this project forward, including promptly signing a document it has already initialed. In sum, neither company has honored the commitments made to us and to the Government of Guinea to proceed with drilling. We will continue with our efforts to get this well drilled, and we are considering all of our options to accomplish this key objective."

Pursuant to the agreement between Tullow and a subsidiary of Hyperdynamics in 2013 in connection with the sale to Tullow of a portion of Hyperdynamics' interest in the Concession, Tullow agreed to drill an exploratory well and to pay all of the costs of Hyperdynamics' participating share of expenditures associated with joint operations up to a gross exploration cap of $100 million. The participating interests are owned 40% by Tullow, 37% by Hyperdynamics and 23% by Dana.

With recoverable oil reserve estimates of approximately 750 and 600 million barrels (mmbbl) in Uganda and Kenya respectively, and with government share of the reserves expected to be about 30–50%, the potential impact on economic development in these countries could be great. However, new infrastructure, including an export pipeline, is required to enable commercialization of these discoveries, says an analyst with research and consulting firm

With recoverable oil reserve estimates of approximately 750 and 600 million barrels (mmbbl) in Uganda and Kenya respectively, and with government share of the reserves expected to be about 30–50%, the potential impact on economic development in these countries could be great. However, new infrastructure, including an export pipeline, is required to enable commercialization of these discoveries, says an analyst with research and consulting firm  Forum AMC wins multi-million dollars worth of new orders for its industry-leading rotational torque unit.

Forum AMC wins multi-million dollars worth of new orders for its industry-leading rotational torque unit. The 23,000-ton spar has been moored by nine Series III Ballgrab ball and taper mooring connectors attached to polyester mooring lines. The connector's male mandrels are manufactured in compliance with American Bureau of Shipping (ABS) 2009 Approval for specialist subsea mooring connectors.

The 23,000-ton spar has been moored by nine Series III Ballgrab ball and taper mooring connectors attached to polyester mooring lines. The connector's male mandrels are manufactured in compliance with American Bureau of Shipping (ABS) 2009 Approval for specialist subsea mooring connectors. Statoil

Statoil Hyperdynamics Corporation

Hyperdynamics Corporation Marred by corruption and market turmoil, Petrobras, the operator of key pre-salt projects for Brazil’s oil production over the next five years, is one of many Brazilian oil and gas companies facing a difficult financial future in the short term, according to an analyst with research and consulting firm

Marred by corruption and market turmoil, Petrobras, the operator of key pre-salt projects for Brazil’s oil production over the next five years, is one of many Brazilian oil and gas companies facing a difficult financial future in the short term, according to an analyst with research and consulting firm  The main supplier agreement lasts for six years, with a four-year option for extension. It covers the following licences and installations:

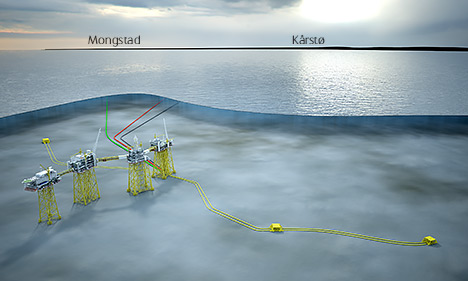

The main supplier agreement lasts for six years, with a four-year option for extension. It covers the following licences and installations:

DNV GL

DNV GL The Bureau of Safety and Environmental Enforcement (BSEE) has announced that offshore oil and gas lessees and owners of operating rights are now required to submit summaries of their actual expenditures for the decommissioning of wells, platforms and other facilities on the Outer Continental Shelf (OCS) as part of the final Decommissioning Costs Rule.

The Bureau of Safety and Environmental Enforcement (BSEE) has announced that offshore oil and gas lessees and owners of operating rights are now required to submit summaries of their actual expenditures for the decommissioning of wells, platforms and other facilities on the Outer Continental Shelf (OCS) as part of the final Decommissioning Costs Rule. Prosafe and Statoil (U.K.) Ltd (“Statoil”) have agreed to re-phase the Mariner Project in the UK Continental Shelf of the North Sea from 2016 into 2017, and extend the firm hire duration from 8 months to 13 months.

Prosafe and Statoil (U.K.) Ltd (“Statoil”) have agreed to re-phase the Mariner Project in the UK Continental Shelf of the North Sea from 2016 into 2017, and extend the firm hire duration from 8 months to 13 months. Maintenance work on the Norne FPSO. (Photo: Rune Solheim)

Maintenance work on the Norne FPSO. (Photo: Rune Solheim)  Anadarko Petroleum Corporation

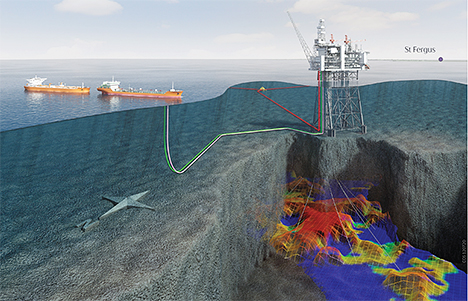

Anadarko Petroleum Corporation Pipeline development projects are becoming increasingly complex, spanning longer and deeper terrains. Pipelines must operate at higher pressures and temperatures, in harsher environments and to stricter regulatory requirements. Projects must also be feasible in a cost-constrained market. DNV GL is inviting industry players to take part in two Joint Industry Projects (JIP) to help the industry work more efficiently while maintaining safety.

Pipeline development projects are becoming increasingly complex, spanning longer and deeper terrains. Pipelines must operate at higher pressures and temperatures, in harsher environments and to stricter regulatory requirements. Projects must also be feasible in a cost-constrained market. DNV GL is inviting industry players to take part in two Joint Industry Projects (JIP) to help the industry work more efficiently while maintaining safety.